Tazia Khushboo

I am a Ph.D. Candidate in Economics at the University of Calgary.

I am an applied economist with research interests in labor economics and international economics. My work examines how trade policies and resource sector shocks affect product and labor markets.

I am on the 2025-2026 job market!

Welcome

Research

Job Market Paper (JMP)

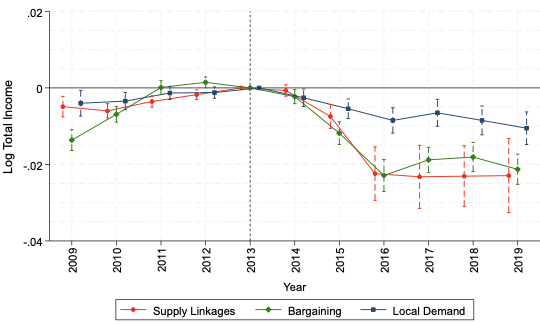

We study the impact of the 2014-16 oil price crash on workers employed outside the oil and gas (O&G) sector in Canada using matched employer-employee data. We create three exposures through which the shock propagated to workers across industries and provinces: the labor market channel, the supply chain linkage, and the local demand channel. Workers employed at firms that previously lost many workers to O&G experienced a negative shock to their outside option due to displacement of their past co-worker networks. Firms that supply to oil and gas or depend on local demand from O&G workers experienced a drop in their sales due to the sector’s collapse. Workers employed at such firms were exposed via decline in their share of quasi-rents. We find that workers affected through the supply linkage channel experienced the largest drop in earnings. These workers mostly belonged to the lower end of the skill distribution and were employed at the lowest-paying firms before the price shock.

Notes. Impacts of exposure to the oil price shock through distinct channels: Employment networks are as just as important as production networks for sectoral shock propagation when the collapsed sector is a high-paying employer.Publication

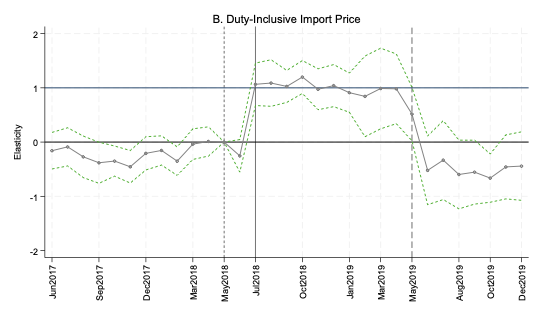

When the United States imposed tariffs on Canadian steel and aluminum in 2018, Canada responded with retaliatory tariffs on US goods worth $16.6 billion. I analyze how much of these tariffs passed through to import prices. The extent to which import prices increase because of tariffs is the tariff pass-through rate. A lower pass-through indicates that foreign exporters—rather than domestic importers—paid for most of the tariffs, implying better welfare consequences for the tariff-imposing country. Using Canadian import data and retaliation information, I exploit a triple-difference strategy to estimate the pass-through of Canada's retaliatory tariffs. On average, import prices increased to reflect the full tariffs, leading to zero terms-of-trade gains and welfare losses of $464 million. Thus, each dollar of the $1.76 billion tariff revenues raised imposed an average cost of $1.26 on Canadian importers. However, product-level analysis reveals that pass-through was incomplete for a subset of the targeted US products.

For targeted U.S. products, duty-inclusive import prices rise one-for-one with tariffs, implying full tariff passthrough. Building an HS8 Crosswalk between the U.S. and Canada: Machine Learning for Harmonized Code Concordance

Work In Progress

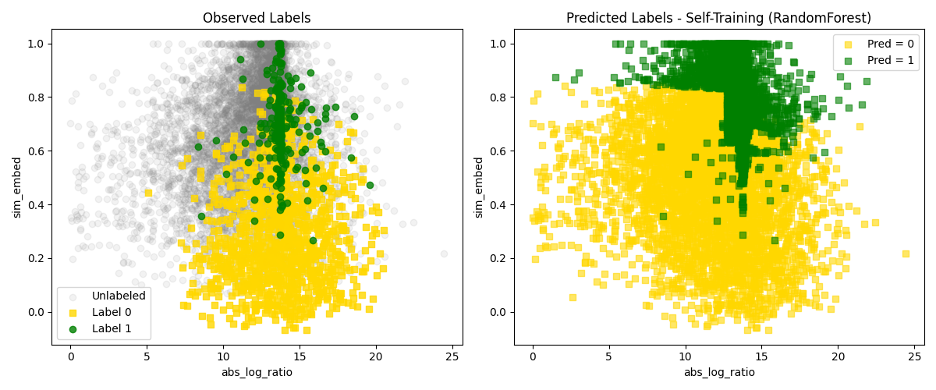

I create a crosswalk between U.S. and Canadian HS8 product codes using machine learning methods to improve precision in studies documenting the impacts of trade policies and tariff wars. The Harmonized System (HS) provides a standard system for tracking the flow of goods in international trade at various degrees of granularity ranging from two to six digits. To track goods at a finer level of disaggregation, countries have developed their own system of HS8 and HS10 product codes. However, these country-specific HS codes are not directly comparable. Tariff implementation in the U.S. and Canada is based on the HS8 codes. The lack of comparability between the U.S. and Canadian HS8 codes precludes observing which products leaving the U.S. are subject to tariffs when they enter Canada. The crosswalk I create solves this problem. I leverage similarity based on trade values and product descriptions between the two systems to generate matches using competing machine learning models by leveraging 263 product matches from Khushboo (2025) as “ground truth” data. I find that a semi-supervised Self-Training model based on the Random Forest Classifier performs the best in terms of key evaluation metrics. This is the first work documenting cross-country HS8 product codes. Although the motivation for this project comes from the desire to study the effect of tariff wars in Canada, the methods documented can be used to create an HS8 concordance between any two countries.

Notes. Self-training with Random Forest Classifier does a better job of labeling true matches that have lower textual similarity and are tightly centered in terms of trade similarity.Teaching Experience

Lecturer in Economics

Brac University

ECO 101: Principles of Microeconomics Spring/Summer 2019

ECO 201: Mathematics for Business and Economics Spring/Summer 2019

Sessional Instructor

University of Calgary

ECON 201: Principles of Microeconomics Summer 2025

University of Calgary

ECON 633: Graduate Labour Economics Fall 2024

ECON 201: Principles of Microeconomics Fall 2022, Winter/Fall 2024

ECON 301: Intermediate Microeconomics Fall 2019, Winter 2020, Fall 2020, Fall 2021

ECON 489: Economics of the Movie Business Summer 2020

ECON 491: Managerial and Decision Economics Summer 2020, 2021

ECON 303: Intermediate Economic Theory - Macroeconomics I Summer 2023

ECON 337: Development Economics Winter 2023

ECON 311: Computer Applications in Economics Summer 2024

ECON 405: Political Economy of Public Policy Winter 2021

Teaching Assistantships

University of British Columbia

ECON 351: Women in the Economy Winter 2018

ECON 370: Cost-Benefit Analysis Fall 2017